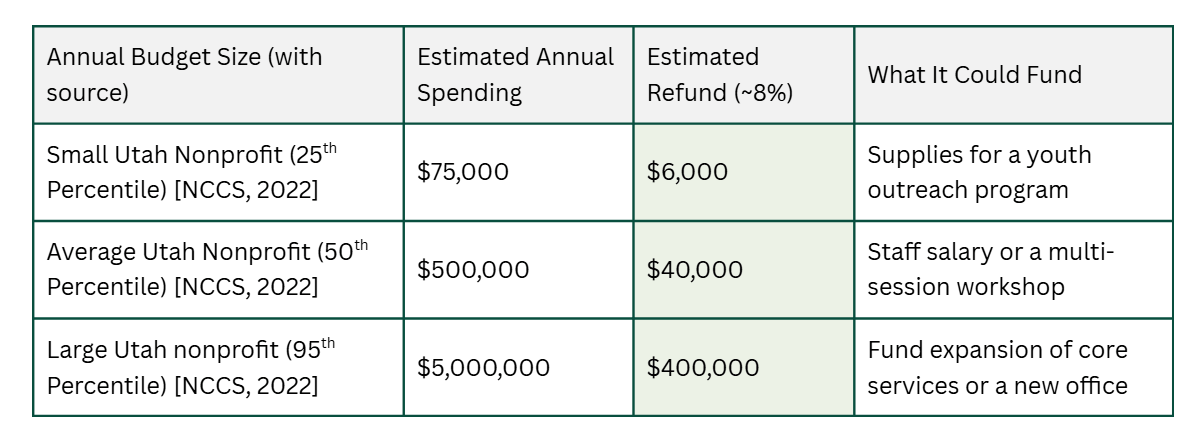

Utah is one of the few states that allows qualifying charitable organizations to claim a refund on sales tax paid for purchases. For nonprofits operating on tight budgets, these refunds can make a real difference. The effective rate typically ranges between 7.75% and 8.25%, depending on local tax rates. In practical terms, that means for every $10,000 spent on eligible purchases, an organization could recover more than $800.

These refunds are not automatic. They require careful documentation and a formal filing with the Utah State Tax Commission. Many nonprofits miss out simply because they are unaware of the program or find the process too tedious.

Eligibility for the Utah Nonprofit Sales Tax Exemption and Refund

Not every organization qualifies, but many 501(c)(3) nonprofits do. To be eligible:

- The organization must be recognized as a charitable institution under IRS rules.

- The nonprofit must obtain a Utah Sales Tax Exemption Number by filing Form TC-160 (Sales Tax Exemption Application).

- Purchases must be made in the name of the organization, not by individual staff members or volunteers.

Examples of eligible organizations include food banks, educational charities, animal rescues, arts nonprofits, and religious charities.

The Utah Nonprofit Sales Tax Exemption and Refund Process

Nonprofits in Utah can save money on sales tax, but the process depends on the size of the purchase. Large purchases are exempt at the time of sale, while smaller ones can be refunded later through a form.

1. Purchases $1,000 or more → If the purchase is made in the name of the nonprofit and paid with organizational funds, the exemption must be requested at the point of sale. The seller may ask for proof of nonprofit status (like an IRS determination letter).

2. Purchases under $1,000 → For smaller, everyday purchases under $1,000 (excluding utilities and contract-based expenses), nonprofits can get their sales tax refunds by filing Form TC-62N: Sales Tax Refund Request.

Key Rules for TC-62N:

- Refund claims must be mailed (no online submission).

- Refunds can be filed once per month (Utah provides 12 coupons per year).

- Nonprofits must keep receipts for all purchases claimed that month.

- Refunds must be requested within three years of the purchase date.

Budget Impact of Utah Sales Tax Exemptions

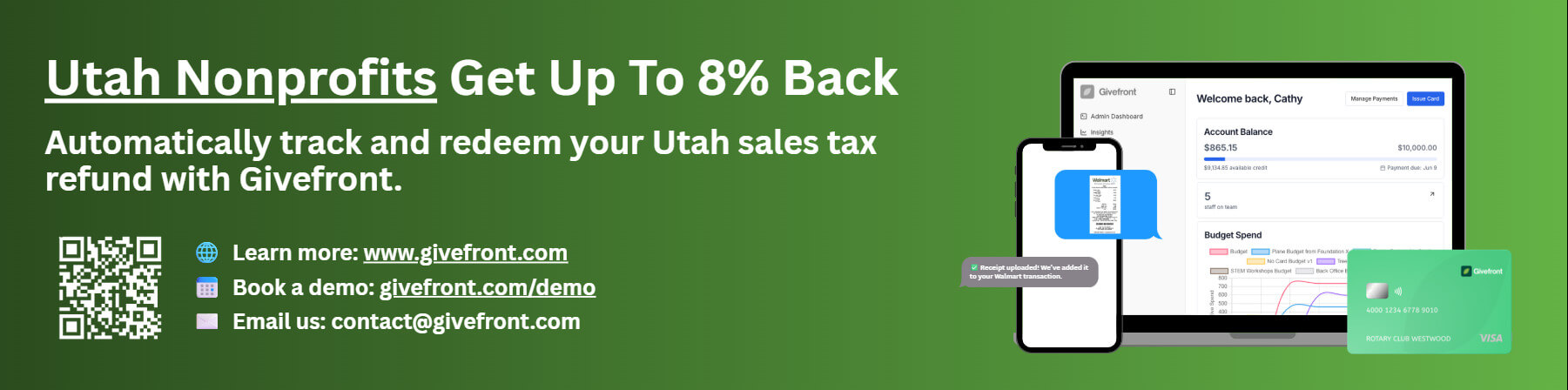

Givefront Helps to Automate Utah Nonprofit Sales Tax Refunds

For most nonprofits, keeping up with every single purchase is exhausting. Each receipt, each line item, and each form adds up to hours of work for a small team.

Givefront provides nonprofit-first expense tools that make sales tax refunds automatic:

- Collect receipts from staff instantly by text or email

- Detect and record sales tax on every transaction

- Prepare and track your TC-62N filings so nothing gets missed

Most small and midsized nonprofits using Givefront recover $2,000 to $10,000 every year.

Why Utah Nonprofits Should Act Now

Each year, thousands of dollars in potential refunds go unclaimed because organizations are unaware of the process or underestimate its importance. By starting early, keeping accurate records, and leveraging modern financial tools, Utah nonprofits can ensure they maximize every dollar available to them.

About the Author

Givefront – The financial management platform built for nonprofits.

Givefront helps organizations simplify expense tracking, automate compliance tasks, and recover thousands each year in overlooked sales tax refunds.

Our nonprofit-first tools include:

- Corporate cards built for nonprofits – with built-in controls and oversight

- Instant receipt capture – staff can text receipts on the go

- Smart budget and grant tracking – no more messy spreadsheets

- Automatic sales tax refunds in Utah – up to 8% savings without extra work

As a proud Utah Nonprofits Association Champion, Givefront is here to help your organization save time, stay compliant, and put more dollars back into your mission.

🌐 givefront.com | 📧 contact@givefront.com | 📅 Book a demo with the Givefront team